Associated Press

- India may start a pilot program for a digital currency in December, the head of the Reserve Bank of India told CNBC.

- RBI Governor Das said testing will include scrutiny on security and the impact on monetary policy.

- The majority of the world's central banks are studying the usage of central bank digital currencies, or CBDCs.

- See more stories on Insider's business page.

India may be ready to test a digital rupee as 2021 comes to a close, the head of the Reserve Bank of India told CNBC, underscoring interest among central banks worldwide to experiment with or fully launch digitized currencies.

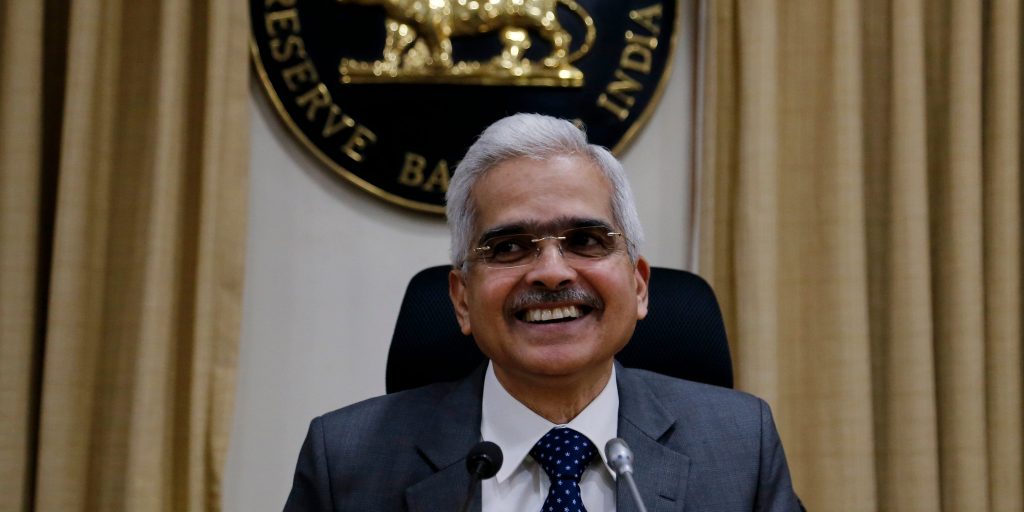

The RBI is on track by at least December to begin a pilot program for a central bank digital currency, or CBDC, RBI Governor Shaktikanta Das said in a pre-recorded Thursday interview with CNBC.

"We are being extremely careful about it because it's completely a new product, not just for RBI, but globally," Das said.

The security of a digital rupee is a top priority in studying various aspects of operating such an asset, he said. "The possibility of cloning … should be avoided."

The RBI will also examine the impact a CBDC will have on the financial sector, monetary policy and on currency in circulation, and it will assess technological issues.

The potential testing at the RBI highlights that five countries have fully launched a digital currency, according to think tank Atlantic Council, with the Bahamian Sand Dollar the first one to become widely available, and 14 other countries are in the pilot stage with CBDCs.

86% of central banks are exploring central bank digital currencies, according to a survey by the Bank for International Settlements published in 2020. Federal Reserve Chairman Jerome Powell has said a research paper on whether the Fed should establish a digital currency will likely be published in September.

El Salvador thrust itself into the spotlight surrounding digital currencies in becoming the first country to adopt bitcoin as legal tender, with usage set to launch on September 7. The country is installing 200 bitcoin ATMs ahead of the launch and these will work alongside the government's cryptocurrency app called Chivo.

The International Monetary Fund is among the entities to raise concerns about the country's bitcoin adoption. Fitch Ratings this month said the move poses a serious credit risk to its local insurance companies.

In Venezuela, the central bank plans to launch a digital bolivar and plans to redenominate its currency in October.